Do you know what an emerging market economy is? It's a concept that has received much attention in recent years as more and more countries are becoming economically developed and joining the lucrative global markets.

Understanding what it is, how it works, and its various benefits can help businesses identify potential growth opportunities. This blog post will delve into the details to learn about what an emerging market economy is composed of and why it's important for economic development.

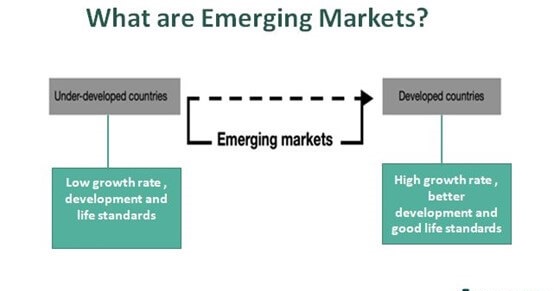

An emerging market economy (EME) is a developing economic system in which economic growth and structural changes occur.

It is characterized by rapid economic expansion, the emergence of new sectors, and the opening up markets to foreign competition. The main features of an EME include the following:

An emerging market economy offers investors numerous opportunities to increase their wealth. By investing in these markets, investors can access new and potentially profitable businesses that may not be available in other, more developed countries.

For example, EMEs provide access to high-growth sectors such as technology and financial services, which have immense potential for future profits. Additionally, EMEs may provide investors with access to assets that have a lower cost of entry and relatively high returns.

Investing in an emerging market economy carries higher levels of risk than investing in more established and developed economies. The risks can be divided into two categories: financial and political.

Financial risks include currency devaluation, economic volatility, and the lack of liquidity in the markets. Political risks can cover anything from corruption to the takeover of assets. Additionally, EMEs are often subject to changes in government policies that can affect investors' returns.

Investors need to research the political and economic environment of the countries they are considering investing in before making any decisions. Additionally, it is wise to diversify investments across multiple EMEs to mitigate risk.

1. Do your research: Investing in EMEs carries higher levels of risk than investing in more established and developed economies, so it is important to do your due diligence before making any investments. Research the political and economic environment of the countries you are considering investing in before making any decisions.

2. Diversify: Investing in a single EME carries higher levels of risk than investing across multiple EMEs. Diversifying your investments across several countries can reduce the overall risk of your portfolio.

3. Choose carefully: Not all EMEs are created equal, so it is important to weigh your options and choose wisely. Look for countries with stable governments and strong economic fundamentals. Additionally, consider the sectors that you are interested in investing in and look for countries that offer access to those areas.

4. Have a plan: As with any investment decision, it is important to enter the market with an exit strategy in mind. Know when you plan on exiting your position to maximize your returns and minimize your losses.

Emerging markets are becoming increasingly important in the global economy. Many of these countries have experienced rapid economic growth in recent decades and offer significant opportunities for companies looking to expand their businesses beyond their home markets.

Emerging markets provide access to new customers, new suppliers, and potentially cheaper labor costs than developed economies. In addition, many of these countries have strong cultural ties to their companies, which can help foster long-term relationships and loyalty. Moreover, as these economies continue to develop, they create greater opportunities for investment and economic growth.

What Is an Emerging Market Economy?

An emerging market economy is defined as a country or region with developing economic systems and low levels of development, often identified by its gross domestic product (GDP). These countries possess low per capita incomes, which leads to greater financial instability. Their economies rely heavily on exports and foreign investments and often have a large informal sector. Countries such as Brazil, China, India, Mexico, and South Africa are examples of emerging market economies.

What Are the Benefits of an Emerging Market Economy?

Emerging markets can offer businesses great potential for growth due to their relatively untapped resources and high demand for products. In addition, these countries often have lower labor costs and less stringent regulations, making them attractive destinations for foreign investments.

What Are the Risks of Investing In an Emerging Market Economy?

While there are many potential benefits to investing in an emerging market economy, there are also some risks. These include higher perceived risk due to lower credit ratings, currency fluctuations, and political or economic instability. Additionally, businesses may need more infrastructure to access local resources and skill sets.

Which countries are emerging market economies?

Some of the most well-known emerging market economies include Brazil, China, India, Mexico, and South Africa. However, many other countries could be considered EMEs, such as Colombia, Indonesia, Malaysia, Peru, and Vietnam.

Investing in an emerging market economy can be a risky but potentially rewarding business venture.

What are the four emerging economies?

Brazil, China, India, and Mexico are the four most well-known emerging market economies. These countries have experienced rapid economic growth in recent years and offer businesses great potential for growth due to their untapped resources and high demand. However, they also pose higher levels of risk than more established markets.

An emerging market economy is in the process of industrialization and modernization. Such economies are typically characterized by rapid economic growth, rising living standards, and increased foreign investment. While risks are associated with investing in emerging markets, many believe the potential rewards outweigh these dangers. With careful research and analysis, investors can profit from the opportunities presented by these dynamic economies.